Accounting info. Accounting info Formation of RSV 1 in 1s 8.3 zup

To automatically generate RSV-1 in 1C 8.2, you must perform the following steps:

- In the Reports → section you need to select Regulated reports;

- By function<Добавить элемент списка>– the RSV-1 PFR form is selected;

- Period – the reporting period is set;

- Next click<Ок>;

- When you press<Заполнить>– the RSV-1 report will be generated automatically in 1C 8.2;

- After this, you need to check the completion of the report and, if necessary, make adjustments to it.

In order to create the printed form RSV-1 in 1C 8.2 Accounting, you need to perform the following steps:

- There is a button at the bottom of the form<Печать>;

- If you select Show form, the print service will open. Then you can print all the sheets in the report, or only those that are checked;

- Print via<Печать>.

How to check the correctness of filling out a report to the Pension Fund of the Russian Federation according to the RSV-1 form in the 1C 8.2 Accounting program is discussed in the form of step-by-step instructions.

Instructions for filling out the RSV-1 form in the Pension Fund of the Russian Federation

Step 1. Filling out the title page

At the first step, information indicators about the taxpayer and the reporting period are generated. A sample title page of the RSV-1 form is presented below:

Step 2. Completing Section 2

In the second section of the RSV-1 form, the calculation established for the taxpayer is made.

Filling out the section on compulsory pension insurance

In the line Base for calculating insurance contributions for compulsory pension insurance (lines 240 and 241), the base is calculated by age:

- For workers 1966 and older according to the formula (page 201+ page 203 – lines 211 -213 -221 -223 -231 -233)

- Let’s say, for example: 80,539.21 + 0 – 0 – 0 – 0 – 0 – 0 – 0 = 80,539.21 rubles. – page 240;

- For persons born in 1967 and younger according to the formula (page 202 – lines 212 – 222 -232)

- Let’s say, for example: 321,295.54– 3,195.63 (sick leave benefit) – 0 – 0 = 318,099.91 rubles. – page 241;

In the line Accrued insurance contributions for compulsory pension insurance, contributions are calculated: insurance and savings part (line 250, line 251), if their amount is more than the maximum value of the base (line 252) according to the formula: Amount of contributions = Base for contributions * Tariff for contributions.

- So, in our case, the calculation of contributions for the insurance part: 80,539.21 * 22% + 318,099.91 * 16% = 68,614.62 rubles.

- The calculation of contributions for the funded part was: 318,099.91 * 6% = 19,086.00 rubles.

Filling out the section on compulsory health insurance

In the line Amount of payments and remunerations in favor of individuals (p. 271) - the amount of payments is written down by month in the reporting period (columns 4-6) and in total on an accrual basis (column 3). Filling is similar to the indicators of the lines on the OPS (lines 201 + 202 + 203 are summed up).

In the line Base for calculating insurance premiums for compulsory medical insurance (p. 275), the base is calculated using the formula (p. 271 - lines 272 – 273 – 274).

- In our case: 401,834.75 – 3,195.63 – 0 – 0 = 398,639.12 rubles – p. 275;

In the line Accrued insurance premiums for compulsory health insurance, contributions to the FFOMS are calculated using the formula: Amount of contributions = Base for contributions * Tariff for contributions.

- Checking the calculation of contributions to the Federal Compulsory Medical Insurance Fund: 398,639.12 * 5.1% = 20,330.60.

You can also check the amounts of contributions with the balance sheet for the credit turnover of accounts 69.03.01 “Federal Compulsory Medical Insurance Fund”. Similarly, you can check calculations for all columns by month of the period:

Example of filling out Section 2 of RSV-1:

Step 3. Completing Section 1

In the first section of the RSV-1 form, the accrued and paid contributions for compulsory pension and health insurance are calculated, and the balance for them is also indicated.

In the line Accrued insurance premiums from the beginning of the reporting period (p. 110) – the total amount of accrued premiums on a cumulative basis from January 1. The data in the line must match:

- amounts from section 2 column 3:

- contributions for compulsory medical insurance – page 276;

- the sum of the data from section 1 page 110 of the calculation of the previous period and the data from section 1 page 114 of the calculation of the reporting period.

In lines 111, 112, 113 – the amounts of contributions accrued for the three previous months are entered. The data in the lines must correspond to the data from section 2, columns 4, 5, 6:

- insurance part – p.250 + p.252;

- accumulative part – page 251;

- contributions for compulsory medical insurance – page 276;

Line 114 reflects the amount of insurance premiums for the last three months of the reporting period, which is determined by the formula (lines 111 + 112 + 113).

In line 130 - the total amount of insurance premiums payable, which is determined by summing lines 100+110+120.

In line 140 - you need to indicate the amount of contributions paid on an accrual basis from January 1 to the reporting date. The data in the line must correspond to:

- debit turnover on accounts 69.02.1, 69.02.1, 69.03.1 in correspondence with account 51;

- the sum of the data from section 1 page 140 of the calculation of the previous period and the data from section 1 page 144 of the calculation of the reporting period;

In lines 141, 142, 143 - you need to enter the amount of contributions paid for the last three months. The data in the lines must correspond to the amounts of monthly contributions (debit turnover on accounts 69.02.1, 69.02.1, 69.03.1);

Line 144 reflects the summation of lines 141 + 142 +143.

Sample of filling out RSV-1 Section 1:

Drawing up a payment order for payment of contributions to the Pension Fund

The procedure for filling out the fields of the payment order when paying monthly insurance premiums to the Pension Fund of the Russian Federation (insurance part):

KBK for payment of contributions to the Pension Fund

In field 104 “KBK” you need to enter the budget classification code for the contribution being paid.

Attention! BCC is an important detail; if it is indicated incorrectly, the insurance premium will not be credited correctly and will entail the accrual of penalties.

In our example, the following BCCs are indicated:

Details for payment of insurance contributions must be found in your pension fund or on the official website of the pension fund. For Moscow, you can use the website www.pfrf.ru/ot_moscow.

Example of a payment order for the payment of insurance premiums to the Pension Fund (insurance part)

To automatically generate a payment order in 1C 8.2, you can use the Generation of payment orders for taxes payment processing through the Bank menu:

Full list of our offers:

Quite recently, the next period for submitting reports to the Pension Fund of the Russian Federation began, and therefore I decided on the pages of this site to talk about how the regulated RSV-1 report is prepared in 1C ZUP edition 3.0.

This article will primarily discuss the sequence of report preparation in 3.0 and, of course, some features that should be checked and taken into account for the correct generation of the DAM. In this regard, I think the article will be useful for both beginners and experienced users of the ZUP 3.0 program (By the way, for beginners of edition 3.0 or for those who want to learn how to eat useful material).

For those who have not yet implemented and are still working in ZUP 2.5, there is also similar material that can be found by clicking on. I published it a little earlier, but it is still relevant today.

Sequence of preparation of the RSV-1 report in ZUP 3.0

✅

✅

✅

To begin with, I will tell you in general how to prepare a regulated report to the Pension Fund.

Everything related to regulated reporting (not only to the Pension Fund, but also to the Social Insurance Fund, Federal Tax Service, etc.) can be found in the main menu section “Reporting, certificates”. To generate the RSV-1 report, you need to use a specialized workstation, which can be launched from this section via the link “Quarterly reporting to the Pension Fund of Russia”.

The main thing here is to use this workbook, and not the 1C-Reporting magazine (in the picture just above). Of course, it will be possible to create an RSV-1 from it, but this report will not contain individual information, they simply will not be filled out with this method of creation. Therefore, it should be used specifically in the workplace “Quarterly reporting to the Pension Fund of Russia.”

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

Before you begin creating a report for the current quarter, you must set the status of the report for the previous quarter to "Submitted" if this has not been done previously. To do this, use the workplace menu item “Set state” and select the “Sent” state.

After this you can use the button “Create a set for _ sq. 201_". A form will open in a new window, which will take some time to fill in with information. After completing this process, we will receive two or more packets of information.

The uppermost pack corresponds to the general sections of RSV-1 (sections 1-5). If we position ourselves on this line, then the basic information from the general sections is presented below. To open and view/check these sections you directly need to click on the line "Sections 1-5".

If we position ourselves on the bottom line (this is a pack of individual information - section 6), then below we will see a list of all employees included in this pack. Here we can see for each its base and calculated insurance premiums.

Of course, all individual information for each individual can be viewed directly in the RSV-1, but it will be quite inconvenient to scroll through this whole “footcloth” and analyze the information in this form.

This window has three tabs. In the first - “Sections 6.4 (earnings), 6.5 (contributions)”— you can view information about the employee’s monthly earnings in the current quarter, as well as accrued contributions (in the picture above).

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

In the second tab, which is called “Section 6.7 (harmful earnings)”, information is provided on earnings, which are subject to additional contributions for harmful and difficult working conditions. Naturally, this tab is filled out only for employees whose position provides for such contributions.

And finally the third tab - "Section 6.8 (experience)". The employee's length of service for the past quarter is reflected here. At the same time, the program itself can break down periods if, for example, there was sick leave or vacation at your own expense. And for pests it is important to indicate correctly in the position special working conditions code and list item code, so that the corresponding fields can be automatically loaded in the experience.

To refill the report, use the button “Update” -> “Update completely”.

If for some reason you made manual changes to the report, but you need to update it, then you can do this without losing the corrections - “Update with corrections.” By the way, employees who have manual corrections will be reflected in bold.

Next to the “Update” button you can see a button "Add". It allows you to manually add another set of sections to the reporting, for example, corrective ones. But I'm back again I don't recommend doing this manually. We have a smart program that knows better how to do this. And so that it can automatically create adjustments, it is enough to reflect in the database the fact of additional accrual of contributions for previous periods, or make a correction for any other situation in connection with which an adjustment is required. The program will track this and create the pack itself (to understand how this is done, you can read the example of articles about adjustments from).

However, there is a useful button here “Add” -> “Additional files”. In my practice, there were situations when the Pension Fund of Russia demanded clarification on some situations in a regular Word file. These are the additional files that are added to the report using this button.

Next, it all depends on what program you use to send the report. If this is a third party program, then from 1C the report must first be downloaded, using the button of the same name in the workplace menu. When uploading, an internal check of the report takes place and if there are errors, the program will tell you about it. The report is then uploaded to the reporting program.

There is another option, more convenient. You can send a report directly from 1C. And confirmation of accepted reports will also come to 1C. Quite convenient and, by the way, cheaper. Connection conditions for different regions are different, so if you are interested in finding out more details, you can . I will be happy to advise you.

That’s all for today, if you have any questions about preparing reports in ZUP 3.0, you can write in the feedback form or.

To be the first to know about new publications, subscribe to my blog updates:

Life does not stand still, as do the changes being made to the laws of our country. So, starting from 2017, calculations for insurance premiums are submitted using the KND form 1151111. These changes were approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-11/551@ dated October 10, 2016. Previously, a report was submitted to the regulatory authority using the RSV-1 form Pension Fund of January 16, 2014. Naturally, the report in the form KND 1151111 appeared in the 1C ZUP and Accounting programs.

Filling out “Calculation of insurance premiums” in 1C

All actions performed will be performed in the 1C 8.3 ZUP 3.1 program. For the 1C 8.3 Accounting program the principle is the same.

First, let's figure out where in 1C 8.3 Calculation of insurance premiums. Go to the “Reporting, references” menu, select “1C-Reporting”. In accounting: “Reports” - “Regulated reports”.

You will see a window with a list of previously created reports. Create a new one.

In the window that opens, go to the “All” tab.

The previous report on the calculation of insurance premiums was located in the “Reporting to funds” group and was called “RSV-1 PFR”. If you select it now, the program simply will not allow you to create it for the period starting from 2017. The reason will also be indicated here - the report has lost its validity.

The new reporting form is located in the “Tax reporting” group. We recommend adding it to your favorites by double-clicking on the star sign with the left mouse button. It is advisable to remove the out-of-date “RSV-1 PFR” report from your favorites to avoid confusion.

After selecting “Calculation of insurance premiums”, a window will appear where you need to specify the organization and period. In addition, there is reference information on deadlines, responsibilities and changes in legislation.

Yellow and light green report fields are available for editing. However, if inaccuracies or errors occur, it is recommended to edit not the report itself, but the data in the program on the basis of which it was generated.

Description of report sections

- The title page is required to be completed by all those responsible for submitting this report.

- Section 1 reflects the total data on insurance premiums that must be paid to the budget. Detailed data on the purpose of these contributions are located in the relevant appendices of this section.

- Section 2 is not displayed in our example, since it is formed by peasant (farm) farms. It will become available when the code for the location of the accounting “124” is indicated on the Title Page.

- Section 3 contains detailed information about individuals, indicating their passport details, TIN, SNILS and other things.

Calculation of insurance premiums is a quarterly report that, since 2017, all employers are required to submit. Let's look at the procedure for filling out calculations for insurance premiums in the 1C program.

General information

The calculation of insurance premiums essentially replaces the previously presented RSV-1 and 4-FSS in the part of Section I, contains information on the calculation of contributions:

- for compulsory pension insurance (including at additional rates);

- compulsory health insurance;

- compulsory social insurance in case of temporary disability and in connection with maternity.

In addition, the Calculation of Insurance Contributions provides a calculation of contributions for additional social security for members of flight crews and coal industry workers, for which we previously reported in the RV-3 form, as well as a calculation of contributions for the head and members of peasant (farm) households (previously used RSV-2).

Calculation composition

The calculation of insurance premiums consists of

- Title page;

- Section 1 with appendices;

- Section 2;

- Section 3.

Section 1 provides summary data on accrued insurance premiums by type of insurance for the organization as a whole. Section 2 is intended to be completed for insurance premiums of heads of peasant (farm) households and is presented only at the end of the year. Section 3 – personalized information, filled out for each employee of the organization.

IN mandatory The following sections of the calculation are presented in order:

- Title page;

- Section 1;

- Subsection 1.1 (on contributions to compulsory pension insurance);

- Subsection 1.2 (on contributions to compulsory medical insurance);

- Appendix No. 2 to Section 1 (on contributions to OSS);

- if there are employees, Section 3 is also filled out.

The following sections are presented if data is available to fill them out:

- Subsections 1.3.1, 1.3.2 – if contributions are paid at additional rates;

- Subsection 1.4 - if additional social security contributions are paid;

- Appendix No. 3 - if there were expenses for payment of benefits;

- Appendix No. 4 - if there were expenses for benefits financed from the Federal budget;

- Appendices NN 5, 6, 7 - if the organization applies a reduced rate of insurance premiums, which requires justification;

- Appendix No. 8 – filled out by individual entrepreneurs with a patent system;

- Appendix No. 9 – if the organization employs temporarily staying foreign citizens;

- Appendix No. 10 - if the organization uses student labor in construction teams:

Example of filling in 1C

Let's look at filling out the calculation of insurance premiums in 1C using the following simple example:

| Worker | Earnings for 1 quarter 2017 | Contributions to OPS | Contributions to compulsory medical insurance | Contributions to OSS |

| Afanasyev A.A. | The salary is 150,000 rubles. | 33 000 | 7 650 | 4 350 |

| Lopyreva L.L. | The salary is 150,000 rubles. | 33 000 | 7 650 | 4 350 |

| Romashkina A.A. | On vacation at your own expense | 0 | 0 | 0 |

| Romashkin R.R. | The bonus for the previous period was 10,000 rubles. | 2 200 | 510 | 290 |

| Total: | 68 200 | 15 810 | 8 990 |

To calculate insurance premiums in 1C, the corresponding regulated report is used; it is included in the report category Tax reporting :

To calculate insurance premiums, automatic filling according to information base data has been implemented; for this we use the button Fill :

Calculation verification scheme

It is convenient to check the calculation of insurance premiums using the following scheme:

- first, we check information about earnings and contributions to compulsory pension insurance for each employee in Section 3;

- then calculations of contributions for the organization as a whole - Subsection 1.1. (calculation according to compulsory health insurance), Subsection 1.2 (calculation according to compulsory medical insurance), Appendix No. 2 (calculation according to compulsory medical insurance);

- Please note that the data in Subsection 1.1 must correlate with the data in Section 3, i.e. contributions to compulsory health insurance for the entire organization should be made up of the amounts of contributions to compulsory health insurance for each employee;

- Last of all, we check Section 1, since it contains the final data on accrued insurance premiums for the organization.

Filling out the title page

The cover page for calculating insurance premiums is filled out fully automatically based on the directory data Organizations :

If some information on the title page is not filled out, you should enter it into the directory Organizations and update the calculation using the More button - Update(namely update, not refill).

Completing Section 3

Section 3 of the calculation is filled out by payers for all insured persons for the last three months of the billing (reporting) period, including in whose favor during the reporting period payments and other remunerations were accrued within the framework of labor relations and civil contracts, the subject of which is the performance of work, provision of services under copyright contracts.

Information about the employee must be included in Section 3:

- even if he was not paid anything during the reporting period, but he is our employee under TD or GPA;

- even if he was fired in the previous reporting period, but in the current reporting period there were accruals for which contributions were accrued.

For each insured person, fill out:

- Subsection 3.1 “Data about an individual” - this information is filled in based on the directory data Employees ;

- Subsection 3.2.1 - provides information about the employee’s earnings and accrued contributions to compulsory pension insurance from amounts not exceeding the maximum base value. The information is provided by month of the reporting period and category codes of the insured person.

For an employee who was on leave at his own expense for the entire 1st quarter of 2017, Subsection 3.2.1 is not completed, i.e. We transfer only personal data to it.

The category code of the insured person is determined by the type of insurance premium tariff applied in the organization, as well as whether the employee has the status of a temporarily staying or temporarily residing foreign citizen. For employees of the organization Orange LLC, the category code is used HP.

In our example, Subsection 3.2.1 will be filled out as follows:

Filling out Appendix No. 1

Appendix No. 1 to Section 1 is filled out in terms of payer tariff codes. In our example, the payer's tariff code is 01, which corresponds to the main tariff and the main taxation system:

The explanation of tariff codes can be viewed by double-clicking on the code with the left mouse button; a form for selecting the payer’s tariff code will open with information on the applied taxation system and the tariff of insurance contributions:

Completing Subsection 1.1

Subsection 1.1 provides the calculation of the amounts of insurance contributions for compulsory pension insurance.

The data is given:

- cumulatively from the beginning of the billing period;

- for the last 3 months of the reporting period;

- separately for each month of the reporting period.

In our example, in subsection 1.1 the information is filled in:

- on the number of insured persons;

In the first month, the line with data on the total number of insured persons (line 010) will include all employees, including the dismissed person who was paid a bonus in January 2017 and the employee on leave at his own expense. The line showing the number of persons from whose payments contributions were calculated (line 020) will no longer contain an employee who is on leave at his own expense.

In the next two months, the information on the lines will not contain data about the dismissed employee, because The organization made no further payments to him.

- on the amount of payments, the basis for calculating contributions and the amount of calculated contributions for compulsory pension insurance;

To check the information included in the Calculation of Insurance Premiums, you can use the report Analysis of contributions to funds (in Accounting 3.0 the report is located in the section Salary and HR – Salary reports, in 1C:ZUP 3 – in section Taxes and contributions – Reports on taxes and contributions):

Completing Subsection 1.2

Subsection 1.2 provides the calculation of the amounts of insurance premiums for compulsory health insurance.

This subsection contains information about the number of insured persons, the amount of payments, the basis for calculating insurance premiums for compulsory medical insurance and the amounts of calculated contributions themselves.

In our example for compulsory medical insurance, the number of insured persons, the amount of payments and the base for calculation will completely coincide with the data for compulsory health insurance.

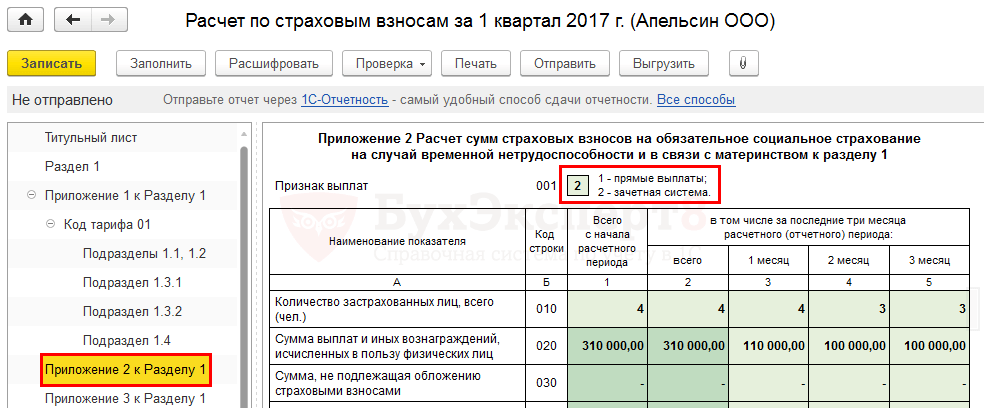

Filling out Appendix No. 2

Appendix No. 2 provides the calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity.

Appendix No. 2 establishes the payment indicator:

- 1 – direct payments (pilot project);

- 2 – credit system.

In the region in which Orange LLC operates, the FSS pilot project does not operate, so in the field Payout sign set to 2.

In our example, for compulsory health insurance, the number of insured persons, the amount of payments and the base for accrual will completely coincide with the data for compulsory health insurance and compulsory medical insurance.

Below in Appendix No. 2 there is a table showing the amount of contributions payable:

Please note that each amount in this table has its own attribute:

- 1 – in the case when contributions are subject to payment to the budget;

- 2 – in the case when expenses (accrued benefits) exceeded contributions to OSS.

In the organization Orange LLC, benefits were not paid to employees, so this indicator has a value of 1 everywhere.

Completing Section 1

Section 1 shows summary data on the obligations of the payer of insurance premiums for compulsory health insurance, compulsory medical insurance and compulsory social insurance in the context of the BCC.

By default, Section 1 is filled in according to the infobase data. In case of making manual edits to the Appendices to Section 1, in order for Section 1 to be filled out according to the data of manual changes, you must use the link Fill out Section 1 according to the application data .

This completes the calculation of insurance premiums for our example.

How to check the calculation

Using a button Examination — Check upload you can check the main errors in the uploaded data (for example, the presence of passport data, SNILS of employees).

The control ratios for the calculation of insurance premiums were sent by Letter of the Federal Tax Service of the Russian Federation dated March 13, 2017 N BS-4-11/4371@. In total, more than 300 control ratios are provided.

What is checked by control ratios:

"Mathematics"— correspondence of indicators by amounts. In particular, an important control ratio must be met: the amount of contributions to compulsory social security for each employee from Section 3 must be equal to the amount of contributions to compulsory security from Subsection 1.1 for the organization as a whole. If this ratio is not met, the tax office will not accept the calculation. When submitting subsequent reports, starting with the report for the half-year of 2017, it is also necessary to check that the indicators of the current report are consistent with the indicators of the report submitted in the previous period.

Personal Information insured persons: full name, SNILS. The reconciliation will be carried out with the information contained in the tax database of the AIS. If the information in the tax database does not match the calculation data, the taxpayer will be denied acceptance of the calculation. Therefore, it is necessary to carefully check the personal data of employees and, if necessary, provide explanations to the supervisory authority.

Reconciliation with 6-NDFL. The following control ratio must be met: the amount of accrued income of the taxpayer, with the exception of the amount of accrued income on dividends in 6-NDFL >= the amount of payments and other remuneration calculated in favor of individuals in the DAM:

Often this control ratio may not be met for various objective reasons:

- different bases for personal income tax and insurance premiums;

- different ways to determine the date of receipt of income for personal income tax and insurance premiums;

- 6-NDFL is submitted for each separate division, and the DAM report is submitted only by separate divisions that pay wages to their employees.

However, if this ratio is not met, you must be prepared to provide written explanations to the tax office.

We are considering a very simple example, so for our example this control relation holds:

Checking the calculation with the Taxpayer Legal Entity program

To check the “mathematics” in the downloaded calculation of insurance premiums, you can use a free program Taxpayer legal entity(posted on the website www.nalog.ru). First you need to load the calculation of insurance premiums using the command Service – Reception of reports from magnetic media, then open the calculation and click on the button Document control.

All companies with at least one employee on staff are required to submit insurance premium calculations to the Federal Tax Service. This information is necessary to track the number and income level of employees. Many people have difficulty generating this report, so we have prepared practical material on the features of creating calculations for insurance premiums in the 1C: ZUP 8.3.1 program.

StageI. Preparatory

Employee income accruals are the basis for generating the “Calculation of Insurance Premiums” report. An employee's income may include the following accruals:

- wage;

- monthly bonuses;

- quarterly;

- annual;

- temporary disability benefits;

- vacation pay;

- and so on.

In order to correctly reflect and generate insurance premiums in the program, you should make the appropriate tariff settings (section Salary → See also → Types of insurance premium tariffs). Rice. 1.

The calculation of the base for calculating insurance premiums is the document “Calculation of salaries and contributions” (section Salary → Calculation of salaries and contributions). Rice. 2.

Click on the “Create” button to create a document and indicate the period for calculating salaries and contributions. Then click the “Fill” button to reflect the employees for whom “Salaries and contributions are calculated.” To obtain information about the base for calculating insurance premiums, you can use the “Analysis of contributions to funds” report (section Taxes and contributions → Reports on taxes and contributions → Analysis of contributions to funds). Rice. 3.

The generated salary accruals and insurance premiums are reflected in the document “Reflection of salaries in accounting”. It displays accrued income and insurance premiums for each employee for the month of accrual.

To correctly reflect insurance premiums in the “Calculation of Insurance Premiums” report, you must correctly indicate the status of the insured person (section Personnel → Employees → Insurance link or in the “Individuals” directory). In the personal card of an employee or individual, you must indicate the date of change of status.

StageII. Generating a report

After we performed in the program “1C: ZUP 8.3.1.” After all the necessary settings and charges, you need to proceed to generating the “Calculation of insurance premiums” report. It is filled out in the section Reporting → Certificates-1C reporting. Click the “Create” button to select the “Calculation of insurance premiums” report and indicate the period for generating the report. The document consists of a title page and sections for reflecting information on the calculation of insurance premiums. Section 1 contains data on the obligations of insurance premium payers. It is filled out according to the ten Appendices that relate to it. This section should reflect the total data on insurance premiums required for payment to the budget. More detailed data on the assignment of contributions is provided in the appendices to this section.

Section 2 “Calculations for insurance premiums” is intended for peasant (farm) farms (peasant farms). Section 3 contains personalized information about individuals, that is, a list of personal data about individuals. So, in addition to the full name and SNILS, the TIN, date of birth, citizenship of the employee, information about the employee’s identity document are provided. The data in this section is compiled based on the results of the last three months of the reporting year.

Cases when section 3 of the report “Calculation of insurance premiums” is completed:

- If payments are made to employees under employment or civil law contracts.

- When an employee is on leave without pay.

- When an employee goes on maternity leave, in the calculation of insurance premiums in Section 3 for an employee on maternity leave, a report is generated without filling out subsection 3.2 on payments.

- If the organization has only one employee, including the director, who is the founder.

- If in the accounting quarter accruals and payments were made for dismissed employees.

The title page, Section 1, Subsections 1.1 and 1.2, Appendix 1, Appendix 2 and Section 3 are made up of all organizations and individual entrepreneurs, payers of insurance premiums, making payments to individuals. Rice. 4.

The remaining sections and applications are formed as necessary, if there is information to fill out.

In the program "1C:ZUP 8.3.1." The “Calculation of insurance premiums” report is generated automatically, subject to the conditions for the correct and timely formation of salaries in the program.

To correctly generate the “Calculation of Insurance Premiums” report, you need to update the program to the current version. Since January 2017, the Federal Tax Service Inspectorate has introduced new conditions for accepting reports: personal data of individuals must completely match the data in the Federal Tax Service Inspectorate database. If the data on employees does not match the data in the Federal Tax Service Inspectorate database, the report will not be accepted by the Federal Tax Service Inspectorate.

In this article, we have highlighted the main points that you should pay attention to when generating the “Calculation of insurance premiums” report. To summarize, I would like to note that correct accounting of the accrual and payment of wages and other charges is an advantage for the correct formation of this document. We wish you successful completion of your annual reporting!

Dear readers, submit your reports without any problems! Our consultants have extensive experience in 1C programs and are ready to help you with the generation of any report. Book a consultation.

Work in 1C with pleasure!